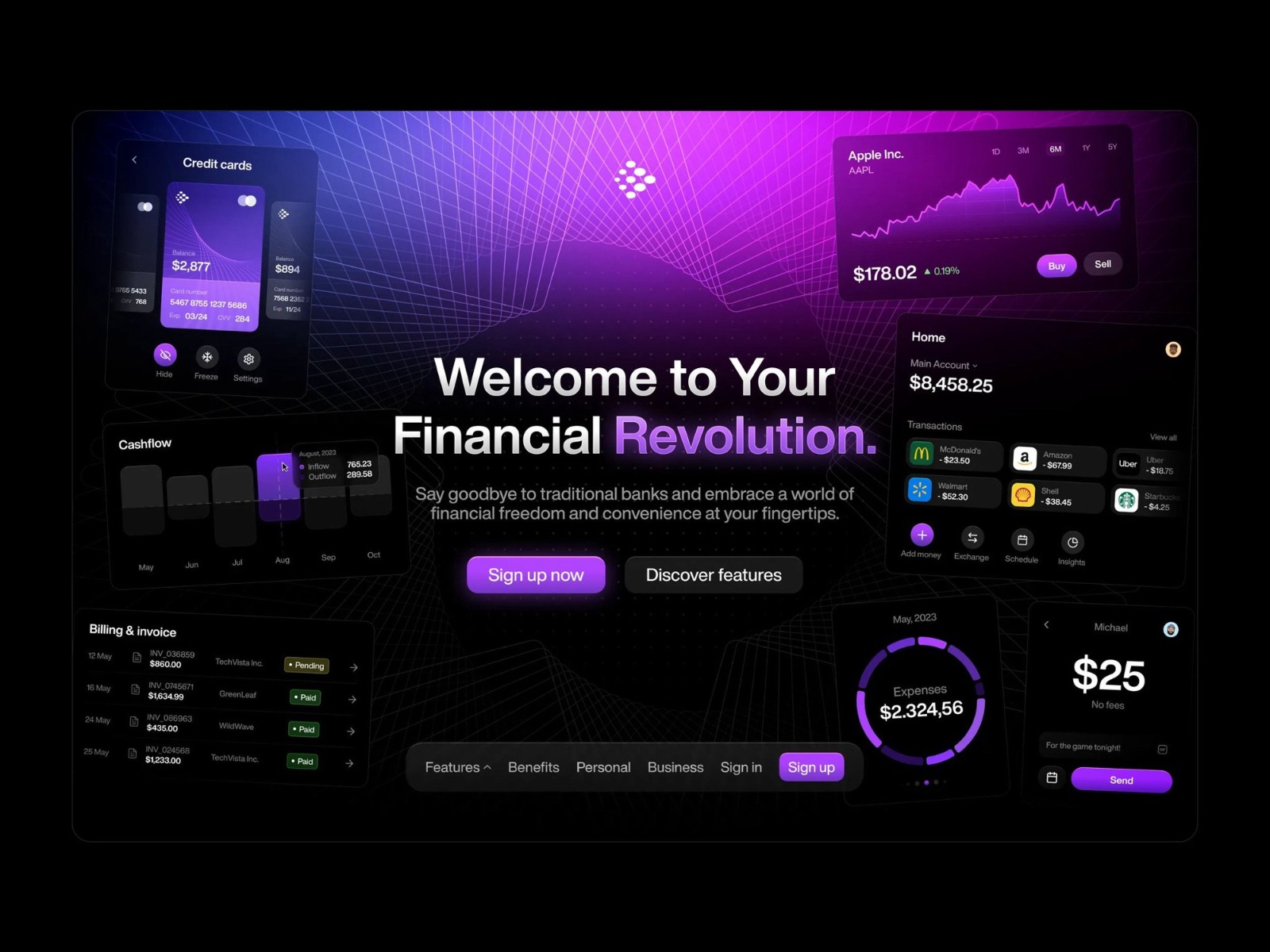

Transforming Finance with Vision AI and Ganerative AI

The BFSI sector thrives on precision, speed, and security. Vision AI and Ganerative AI are revolutionizing this space by automating processes, detecting fraud, enhancing customer experiences, and making data-driven decisions faster than ever.

From personalized financial advice to real-time fraud detection, AI empowers financial institutions to serve customers better and improve operational efficiency

Vision AI analyzes real-time video feeds and transaction patterns to identify suspicious activities instantly.

For example, it can monitor ATMs for skimming devices or detect unusual account Behaviour, like simultaneous logins from different locations.

Why it matters: Prevents losses, reduces false alarms, and protects customers' trust

Vision AI automates identity verification by analyzing government-issued IDs and matching them with live video verification.

Ensures faster customer onboarding while maintaining compliance with strict regulations.

Benefit: Reduces manual effort, speeds up the process, and eliminates human error.

AI-powered systems monitor bank branches and financial institutions to ensure safety.

They can detect suspicious Behaviour, like unauthorized access or loitering near ATMs.

Vision AI analyzes applicant documents and facial expressions during video interviews to detect inconsistencies.

Helps lenders make accurate risk assessments faster.

Customized AI Models: Tailored to meet the unique requirements of banks, insurers, and financial institutions.

Scalable Solutions: Designed to grow with your business as customer demands and data volumes increase.

Regulatory Compliance: Ensures adherence to local and international standards like AML (Anti-Money Laundering) and GDPR.

Proven Expertise: A track record of delivering reliable AI solutions for financial security and customer engagement.

Ganerative AI creates detailed, accurate financial reports and summaries from raw data

Example: AI can draft monthly or quarterly performance reviews with actionable insights for stakeholders.

Advantage: Saves time and ensures consistency in reporting.

AI Ganerates tailored emails, messages, or chatbot responses based on customer profiles and transaction history.

For instance, a customer planning an international trip receives AI-Ganerated suggestions for travel insurance or forex services.

Why it works: Improves customer engagement and cross-selling opportunities.

Automatically creates promotional materials, blogs, or social media posts to target specific demographics.

Result: Scales marketing efforts with consistent branding.

AI analyzes market trends, historical data, and real-time events to Ganerate investment predictions.

Provides advisors with actionable recommendations for their clients.

Impact: Enhances portfolio performance and customer satisfaction.

AI is redefining the BFSI sector. From boosting security to enhancing customer experiences, it’s the competitive edge your business needs.